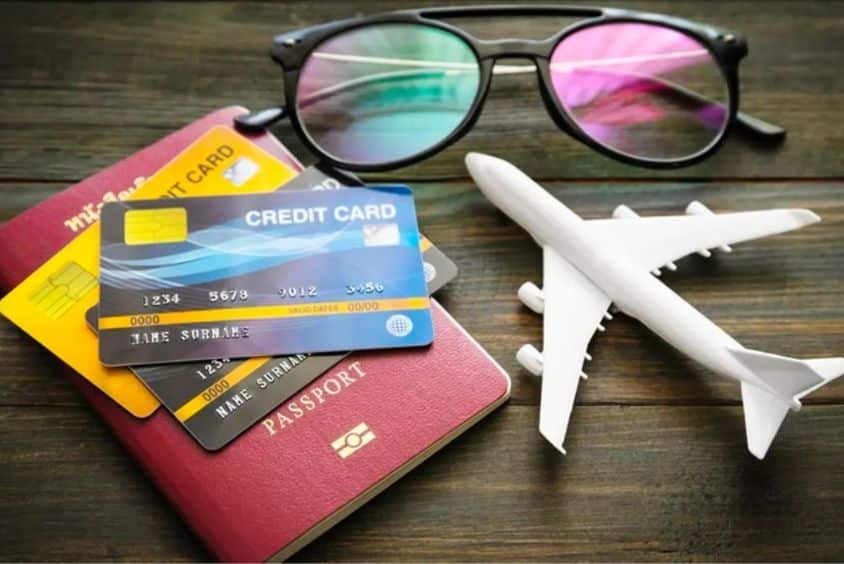

Using a Forex card for international travel has become an increasingly popular and convenient choice for globetrotters and business travelers alike. This financial instrument offers a multitude of benefits that make it a practical alternative to traditional methods of currency exchange and payment when venturing abroad. With the ability to load multiple foreign currencies onto a single card, competitive exchange rates, and enhanced security features, Forex cards provide travelers with a seamless and cost-effective means to manage their finances while exploring the world.

In this article, we will delve into the advantages of using a Forex card, shedding light on how it simplifies currency exchange, eliminates the need for carrying large sums of cash, and ensures financial flexibility throughout the journey. Whether you’re a seasoned traveler or embarking on your first international trip, understanding the merits of a Forex card can significantly enhance your travel experience.

Here are the Benefits of Using A Forex Card for International Travel

Multi-Currency Convenience

One of the standout advantages of Forex cards is their ability to support multiple currencies. When you travel to different countries, you can load various foreign currencies onto a single card. This feature allows you to switch between currencies seamlessly without the need to carry stacks of cash or visit currency exchange counters, making it incredibly convenient for multi-destination trips.

Competitive Exchange Rates

Forex card providers usually offer more favorable exchange rates than traditional exchange methods like airport kiosks or money changers. This means that you get more value for your money when converting your home currency into foreign denominations.

Exchange Rate Lock-In

Many Forex cards provide the option to lock in exchange rates at the time of loading the card. This feature protects you from adverse currency fluctuations during your travels, ensuring you’ll know the exact amount you’re spending in your home currency.

Enhanced Security

Forex cards come equipped with advanced security measures. They are typically PIN-protected, and you can also block the card if it’s lost or stolen, providing peace of mind and safety when compared to carrying large sums of cash.

No Transaction Fees

Most Forex cards do not impose transaction fees when you make purchases or withdraw cash from foreign ATMs. This cost-saving aspect is particularly beneficial for frequent travelers, as it eliminates the extra charges that credit or debit cards may incur for international transactions.

Budget Management

Forex cards are an effective tool for managing your travel budget. By pre-loading a specific amount of money onto the card, you can control your spending while abroad. This feature is especially useful for staying within your financial limits.

Widespread Acceptance

Forex cards are widely accepted at millions of merchants and ATMs worldwide, making them a versatile and hassle-free payment method in most travel destinations. You can confidently rely on your Forex card for daily expenses and cash withdrawals.

Convenient Reload Options

Many Forex cards offer online and mobile app facilities for reloading funds on the go. This flexibility allows you to add more money to your card when needed, giving you financial flexibility during longer journeys without having to search for physical reload locations.

Forex cards are a versatile and cost-effective tool for managing finances while traveling internationally, offering the convenience of multiple currencies, security, competitive exchange rates, and budget control, making them an excellent choice for modern travelers.

Also Read: HOW TO COMPARE AND FIND THE BEST REWARDS CREDIT CARDS

Bottom Line

In essence, utilizing a Forex card for international travel streamlines the financial aspect of your journeys. With the ability to store multiple currencies, competitive exchange rates, enhanced security features, and the elimination of transaction fees, Forex cards ensure convenience and cost-efficiency. They also offer the convenience of online reloading, helping you maintain control over your expenses.

Whether you’re a frequent globetrotter or an occasional traveler, a Forex card can significantly enhance your international adventures by simplifying currency management, ensuring financial security, and allowing you to make the most of your time exploring the world.